The FHA 203K Renovation loan is for primary residences only and can be done on a Purchase or Refinance. The purpose of this loan is to help a buyer with a home that is a “fixer upper” or just someone who wants to update the home to their desired specs

There are two 203K sub-types in the Streamline 203K and the Standard 203K. The Streamline 203K does not allow for structural changes and a maximum $35,000 can be financed for repairs. The Standard 203K allows for structural changes. It can even accommodate a complete tear down as long as a portion of the existing foundation system remains in place. There is no maximum repair limit as long as the entire loan is below FHA’s maximum loan limits for the county. No pools or spas can be built, but small repairs can be made to existing pools. No self-help or sweat equity is allowed. You can finance up to 6 months of payments if home is uninhabitable during renovation.

Normal FHA loan credit qualifying requirements apply with a minimum 640 middle score.

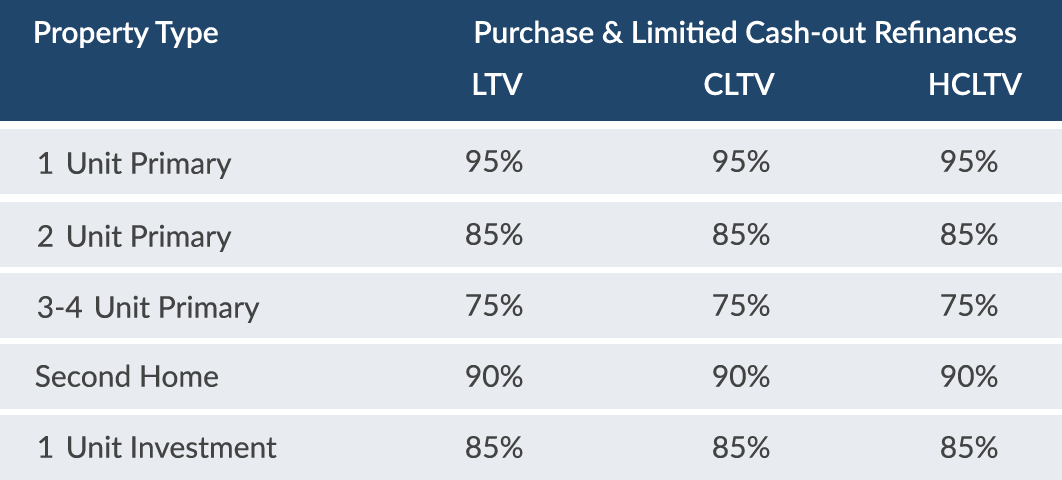

The Homestyle Renovation is the Conventional loan and can be used for Primary Residences, Second Homes, and Investment Properties and works similarly to the FHA 203K with some additional allowable improvements or upgrades. Building a pool and additional structures are allowable. Rehab costs may not exceed 50% of the “as-completed” value of property. No appliances are included, as all items must be permanently affixed. No self-help or sweat equity is allowed. You can finance up to 6 months of payments if home is uninhabitable during renovation.

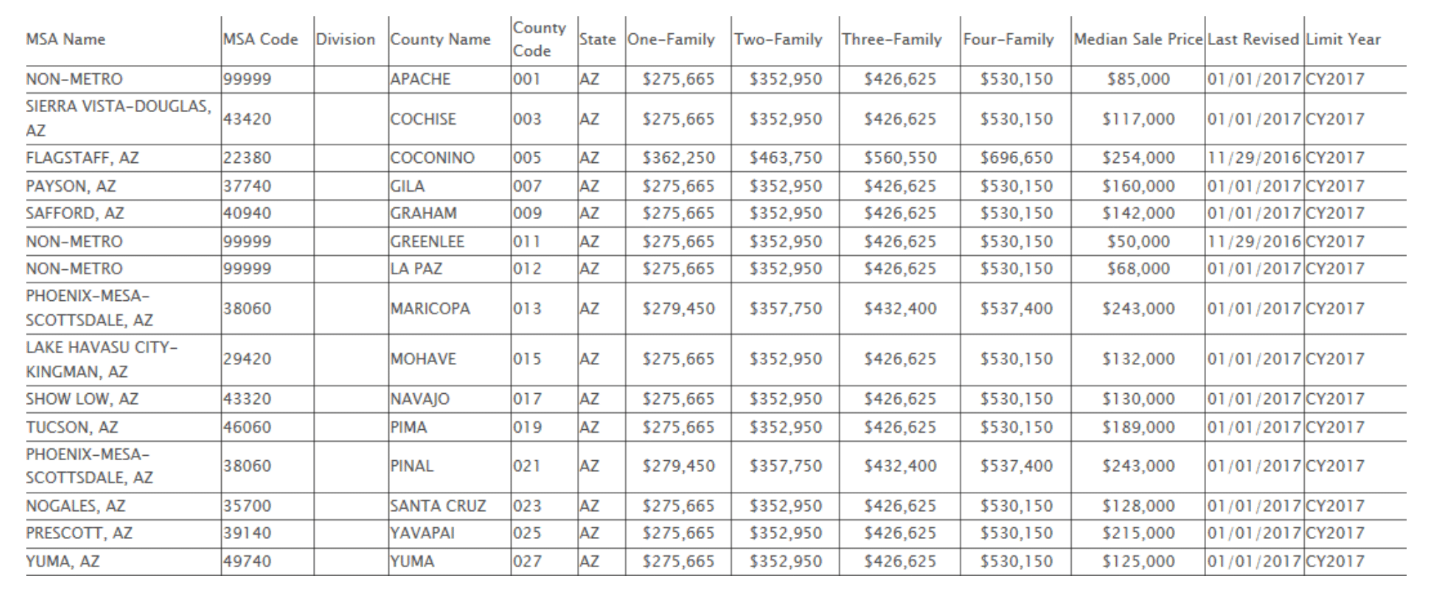

Normal Fannie Mae Conventional loan credit qualifying requirements apply with a minimum 620 middle score. The Conventional loan limit in Arizona for 2017 is $424,100 for 1 unit residences.